With global oil demand growth slow, Saudi Arabian authorities are pulling assets from abroad, unlocking assets from the national balance sheet and prioritizing local development projects to support growth. Looking ahead, the outlook will stabilize as the macro hit from the past production cuts eases, but prolonged higher interest rates and prioritization of local projects weighs on domestic demand. Upsides to the outlook will depend on global demand, via the oil and capital channels. Significant past savings will allow Saudi Arabia to continue investing at home, via the PIF, but domestic liquidity will remain tight, and Saudi Arabia will have tough choices about which domestic and foreign projects to support. Overall, a much greater share of new investments will be deployed at hime.

Recent macro data show a stabilization of economic activity in early 2024. The oil sector continues to be a drag on growth as Saudi Arabia leads OPEC peers in cutting production. Meanwhile non-oil growth, supported by government spending especially from the Public Investment Fund, continues to provide an offset. However, project prioritization and some delays in paying contractors has provided some slowdown. The drag from the oil sector is moderating as the cuts to oil output have remained in place rather than increasing. However, the non-oil sector has struggled from a resumption of contractor payment delays and a prioritization of investments.

If Saudi Arabia and OPEC colleagues are right, that global oil demand growth (especially in China) will pick up later this year and next, allowing for production cuts to be phased out, the oil sector will first become less of a drag and then a positive contribution to economic activity. How much revenue follows will depend on global demand and the price for oil. Overall, the macro data out of the China and government support seem to at best be stabilizing the drop in construction sector rather than boosting the real estate market. Moreover, electrification push seems to be reducing oil and distillate demand growth.

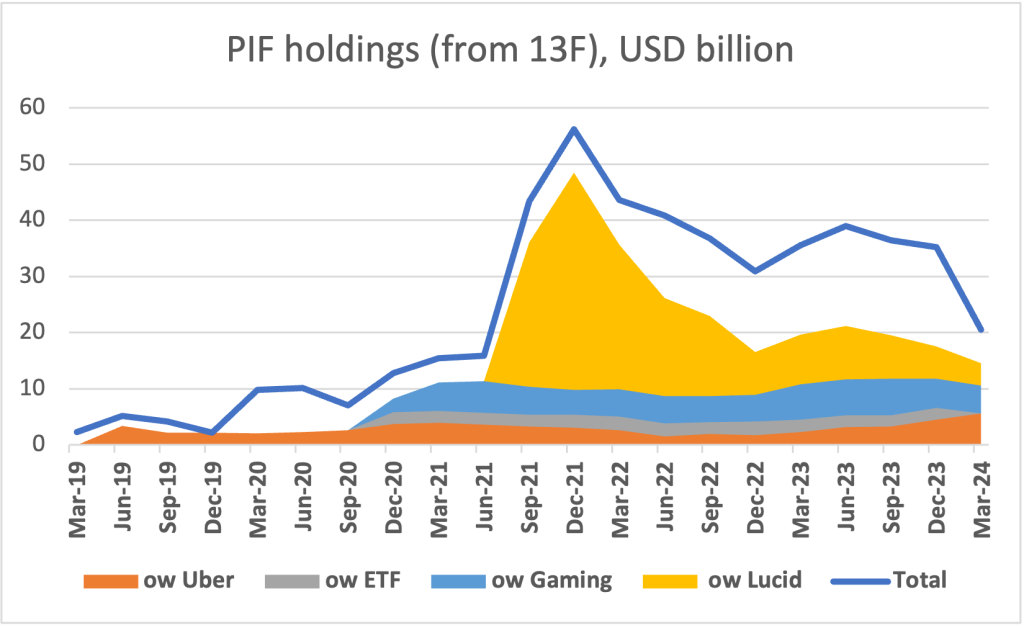

Saudi Arabia is using past savings to support key projects and leveraging its balance sheets to continue economic activity. Government entities issued about $25 billion in debt in the first five months of the year, including the government, PIF and other entities. The recent Aramco secondary sale will also provide liquidity as the government sold a portion of its holdings, likely unlocking another $12 billion. Meanwhile, The Public Investment Fund reduced its holdings of assets overseas in the US from about $35 billion to just over $20 billion by March 2024. While some of this decline reflects valuation changes, especially in the holdings of Lucid, it also reflects sales. Some of these sales could have been used to repatriate assets and support local investments or investments in other countries.

Source: SEC, author calculations

Despite the increase in asset sales at home and abroad, Saudi Arabia still has a lot of balance sheet space which should allow the government to continue stimulating demand and supporting some of its flagship projects. However, it will have to make choices, Meanwhile, Saudi Arabia continues to struggle to attract foreign direct investment in such projects. Interest in the Aramco secondary offer from abroad was reportedly strong (as much as 60% allocation went to qualified foreign investors, likely sovereign wealth partners). However, investment in new projects remains sluggish. Some foreign companies continue to set up offices in Riyadh – a requirement of doing business with the government. Many still seem to be hoping for Saudi Arabia to deploy funds abroad. The time of great petrodollar outflows is over – not because of any great geopolitical rupture with the US, but more because Saudi Arabia is looking to deploy more of its revenues at home.