It's always tough to look into the policy crystal ball... all the more so with the incoming administration. But here's an attempt on the sanctions side to map recent trends. What are you watching? With the Trump administration set to take office soon, there are many questions about the evolution of financial sanctions policies and… Continue reading A Look into the Sanctions Crystal Ball

Tag: sanctions

Venezuela: Potential Energy Implications of Jan 10

This note is one of a few I have planned on the state of sanctions going into the next administration. To hear more, join a webinar I’ll be speaking at on 14 January with Dow Jones Compliance. January 10 is set to bring the re-installation of Nicolas Maduro in Venezuela, many months after the election that he… Continue reading Venezuela: Potential Energy Implications of Jan 10

Iranian oil in the cross-hairs: Physical, Cyber or Sanctions attacks? Potential Impact on oil and other markets

Since Iran sent missiles into Israeli territory last Tuesday night global oil markets have been focused on the risk of attacks on Iranian energy infrastructure. Oil prices rallied over $10 quite rapidly reversing previous sharp declines and commentators have a wide range of price forecasts. This note tries to summarize a few of the potential… Continue reading Iranian oil in the cross-hairs: Physical, Cyber or Sanctions attacks? Potential Impact on oil and other markets

Venezuelan Election: Some Things to Watch

Venezuelans go to the polls on Sunday in highly anticipated elections that are key to the country’s future, its impact on the region and to a lesser extent a key test of US sanctions policy. This piece highlights some areas to watch during the election, in the weeks and months of potential negotiation that follow,… Continue reading Venezuelan Election: Some Things to Watch

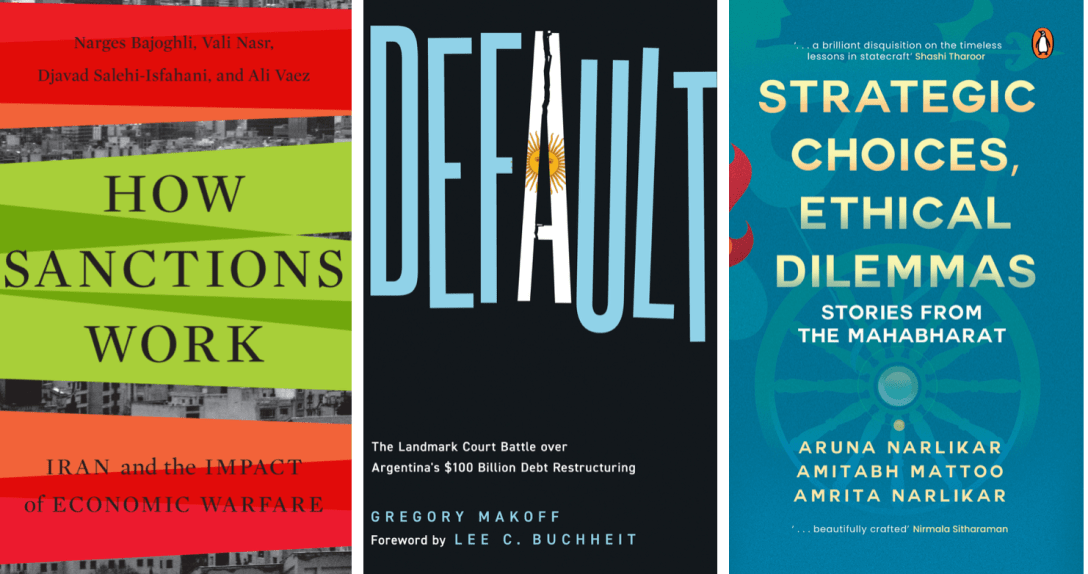

Thought-provoking reads: February edition

Important reads on Argentine economic/debt crisis, the impact of sanctions and Indian foreign policy. Normally I only collect together important reads at year end (see 2023 here), but I decided to make an exception. These three books are important enough in their various areas of foreign economic policy that I didn’t want to wait to… Continue reading Thought-provoking reads: February edition

Venezuela Sanctions: Threats of Energy Reversal

The US finally did “something” in response to Venezuelan president Nicolas Maduro’s noncompliance with the Democracy Agreement signed last fall that led to partial sanctions relief on energy, select debt and gold trade. In recent weeks the Venezuelan government has imprisoned opposition members, and the Supreme Court ruling that banned joint opposition Candidate Machado from running… Continue reading Venezuela Sanctions: Threats of Energy Reversal

Some thoughts on Russian oil Price Cap and oil markets

At the beginning of December, the oil price cap and the EU bans on transporting Russian oil hit the one year mark. This was rightly “commemorated” with a lot of analysis about the limited effectiveness of the cap and Russian energy sanctions, particularly since mid 2023 when prices rose with OPEC+back in the drivers seat.… Continue reading Some thoughts on Russian oil Price Cap and oil markets

Update on the State of the Russian Economy and Sanctions

Many of us are contemplating lessons over the last year following Russia's 2022 invasion of Ukraine - I tackled some lessons about sanctions effectiveness and surprises in another post. This one addresses the state of play in Russia's economy and the outlook for sanctions. Overall, with the US government relatively satisfied with the oil price… Continue reading Update on the State of the Russian Economy and Sanctions

One Year on, Assessing the Impacts of Russia’s War Against Ukraine: A Conversation with the Doorstep podcast

At the beginning of February, I had the chance to chat with the hosts of the Doorstep Podcast. Tetiana Serafin and Nick Gvosdev about the state of the global economy, the resilience of the Russian economy and the rerouting of global trade. An excerpt is below but you can watch or read the whole thing… Continue reading One Year on, Assessing the Impacts of Russia’s War Against Ukraine: A Conversation with the Doorstep podcast

Update on the Russian Oil Price Cap: Deadlock on the “Price”

On, 25 November, EU officials have again failed to reach consensus on the price for Russian oil that would allow an exemption from the EU ban on using its services to transport and sell Russian seaborne crude (aka the G7 price cap). Officials have agreed to resume talks next week, a week out from the 5… Continue reading Update on the Russian Oil Price Cap: Deadlock on the “Price”