Next week brings the confluence of the BRICS Summit in Kazan, Russia and the IMF/World Bank Annual meetings in Washington. The timing seems unlikely to be coincidental but will make for a lot of global macro and geopolitical headlines. As I’ll be watching for news from the first and attending the latter (reach out if… Continue reading Some things I’m Watching at the BRICS+ and IMF Meetings

Category: Uncategorized

Iranian oil in the cross-hairs: Physical, Cyber or Sanctions attacks? Potential Impact on oil and other markets

Since Iran sent missiles into Israeli territory last Tuesday night global oil markets have been focused on the risk of attacks on Iranian energy infrastructure. Oil prices rallied over $10 quite rapidly reversing previous sharp declines and commentators have a wide range of price forecasts. This note tries to summarize a few of the potential… Continue reading Iranian oil in the cross-hairs: Physical, Cyber or Sanctions attacks? Potential Impact on oil and other markets

Some thoughts on Harris’ Economic Plans

Note: This piece was slightly updated after first publishing to incorporate more details on the planned critical mineral stockpile and other steps to address these supply chain vulnerabilities which were mentioned in the speech and accompanying press release. The Harris Walz campaign released a more detailed note on planned economic policy initiatives today accompanying a major economic… Continue reading Some thoughts on Harris’ Economic Plans

Reading the Tea leaves on Harris Trade policy: Targeted Tariffs and Sectoral Agreements?

This post was slightly updated after posting to include a little more of a bottom line on the trade/fiscal/monetary policy mix between the likely Harris and Trump policy. The Harris campaign and surrogates have been, rightly in my view, very critical of proposed broad-based tariffs floated by former President Donald Trump. Armed with good analysis from… Continue reading Reading the Tea leaves on Harris Trade policy: Targeted Tariffs and Sectoral Agreements?

Some thoughts on Canada’s EV Tariffs

On 26 August, the Canadian government formally announced its new long-expected tariffs on Chinese-made electric vehicles, and proposed new surtaxes on many steel and aluminum products. The move, a 100% surtax on many electric vehicles, brings Canada in line with recent US tariffs on such Chinese produced vehicles when it comes into effect on 1… Continue reading Some thoughts on Canada’s EV Tariffs

Venezuelan Election: Some Things to Watch

Venezuelans go to the polls on Sunday in highly anticipated elections that are key to the country’s future, its impact on the region and to a lesser extent a key test of US sanctions policy. This piece highlights some areas to watch during the election, in the weeks and months of potential negotiation that follow,… Continue reading Venezuelan Election: Some Things to Watch

Saudi Arabia: Inward Focus as Global Oil Demand Remains Sluggish

With global oil demand growth slow, Saudi Arabian authorities are pulling assets from abroad, unlocking assets from the national balance sheet and prioritizing local development projects to support growth. Looking ahead, the outlook will stabilize as the macro hit from the past production cuts eases, but prolonged higher interest rates and prioritization of local projects… Continue reading Saudi Arabia: Inward Focus as Global Oil Demand Remains Sluggish

Some thoughts on Critical Minerals: Cautious Optimism, Worries about Chinese overcapacity

The following post draws on conversations around critical mineral supply chains I've had in the last few months including some recently around the SAFE summit in DC earlier in March. Among market participants, there continues to be significant optimism about the overall policy support for renewable energy supply chains and battery development due to incentives… Continue reading Some thoughts on Critical Minerals: Cautious Optimism, Worries about Chinese overcapacity

Mexico and Brazil: Beneficiaries of the Fed Pause and Trade Rerouting

Over the last year, Brazil and Mexico have benefited from the shifting trade relationships and more recently the global disinflationary trends. While the trade vectors are different – Brazil is a rare source of new commodity exports, while Mexico is a near-shoring or China divestment winner, both stand out for their extensive (perhaps over active)… Continue reading Mexico and Brazil: Beneficiaries of the Fed Pause and Trade Rerouting

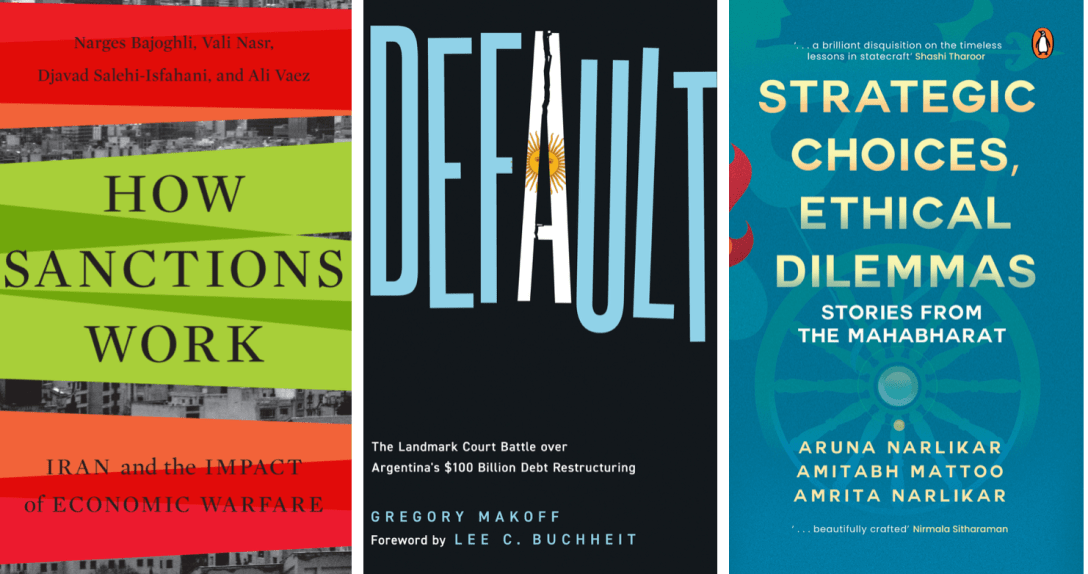

Thought-provoking reads: February edition

Important reads on Argentine economic/debt crisis, the impact of sanctions and Indian foreign policy. Normally I only collect together important reads at year end (see 2023 here), but I decided to make an exception. These three books are important enough in their various areas of foreign economic policy that I didn’t want to wait to… Continue reading Thought-provoking reads: February edition