It's always tough to look into the policy crystal ball... all the more so with the incoming administration. But here's an attempt on the sanctions side to map recent trends. What are you watching? With the Trump administration set to take office soon, there are many questions about the evolution of financial sanctions policies and… Continue reading A Look into the Sanctions Crystal Ball

Tag: Iran

Iranian oil in the cross-hairs: Physical, Cyber or Sanctions attacks? Potential Impact on oil and other markets

Since Iran sent missiles into Israeli territory last Tuesday night global oil markets have been focused on the risk of attacks on Iranian energy infrastructure. Oil prices rallied over $10 quite rapidly reversing previous sharp declines and commentators have a wide range of price forecasts. This note tries to summarize a few of the potential… Continue reading Iranian oil in the cross-hairs: Physical, Cyber or Sanctions attacks? Potential Impact on oil and other markets

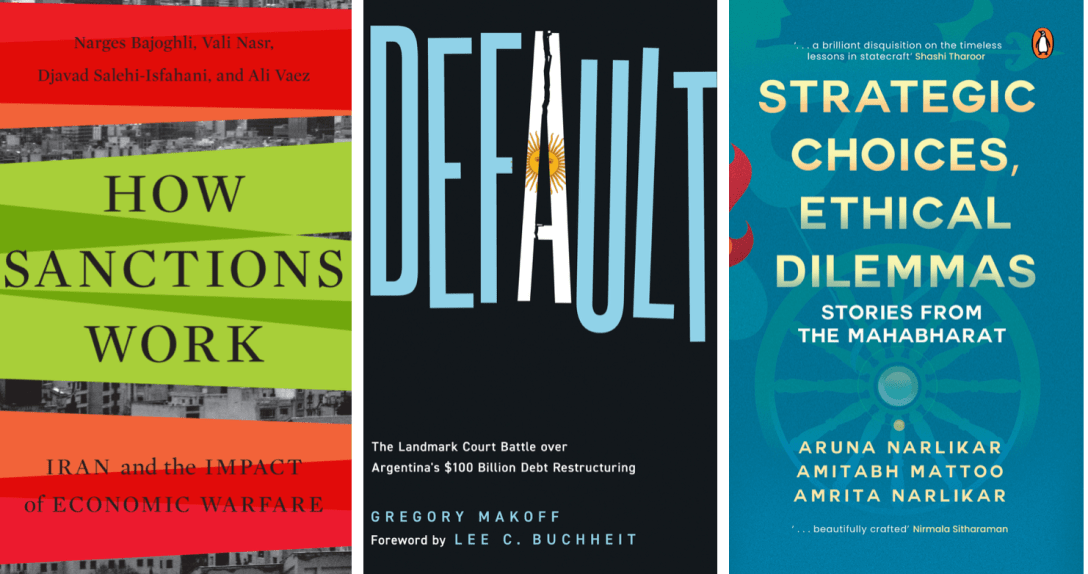

Thought-provoking reads: February edition

Important reads on Argentine economic/debt crisis, the impact of sanctions and Indian foreign policy. Normally I only collect together important reads at year end (see 2023 here), but I decided to make an exception. These three books are important enough in their various areas of foreign economic policy that I didn’t want to wait to… Continue reading Thought-provoking reads: February edition

Are Markets Underestimating the Economic Risks from the Middle Eastern Conflict?

Since October 7, many have asked about the economic risks of the escalating and broadening conflict in the Middle East. Beyond the countries immediately involved, the risks that move the global economic needle linked to the global oil and gas balances, and in the last month, shipping costs. Higher Shipping Costs are Here to Stay,… Continue reading Are Markets Underestimating the Economic Risks from the Middle Eastern Conflict?

Some thoughts on Russian oil Price Cap and oil markets

At the beginning of December, the oil price cap and the EU bans on transporting Russian oil hit the one year mark. This was rightly “commemorated” with a lot of analysis about the limited effectiveness of the cap and Russian energy sanctions, particularly since mid 2023 when prices rose with OPEC+back in the drivers seat.… Continue reading Some thoughts on Russian oil Price Cap and oil markets

OPEC+: Not a mega cut

Today’s OPEC+ meeting confirmed several things. They prefer to boost revenues prices in the face of weak demand. OPEC has little interest in making it easy for the G7 to implement the price cap. There was a need to reset targets to (partly) adjust for massive under production from many producers producers are concerned about… Continue reading OPEC+: Not a mega cut

Iran’s Economy, Sanctions and key Scenarios

On October 7, I was pleased to join the Middle East Institute and Amwaj Media for a discussion about Iran's economy under sanctions and the trend ahead. The discussion coincided with stalled nuclear talks, as maximum pressure sanctions remain mostly in effect, Iran has built up additional nuclear capabilities. Read on or watch the video… Continue reading Iran’s Economy, Sanctions and key Scenarios

OPEC Standoff: Resetting market share

This piece first appeared on the Low Insitute's Interpreter in early July 2021 and concerns the divides between oil exporting nations which are being amplified by the energy transition and uneven recovery. The 1 July OPEC meeting ended in deadlock. Although all the major oil producers agreed in principle to collectively boost production by 400,000… Continue reading OPEC Standoff: Resetting market share

Iran Sanctions: Sell the Fact? What to Watch for on EU, China and Upcoming Energy Measures

Today, the U.S. provided more details on the reimposition of selected financial sanctions, clarifying decisions taken by virtue its repudiation of the JCPOA some months ago. Formally the sanctions, which come into effect today, include measures limiting Iranian access to USD, precious metals including gold, restriction on the auto trade, industry and shipping. The updated… Continue reading Iran Sanctions: Sell the Fact? What to Watch for on EU, China and Upcoming Energy Measures

OPEC Compromise: Can Kicking Buys Time for Sanctions Rollout and Demand

Last week, OPEC+ ministers managed to come to a consensus after days of contentious discussions in Vienna, achieving the goal of formally keeping the OPEC+ alliance together, but failing to solve some of the thorny issues between key members including Saudi Arabia and Iran. The final agreement, which commits the group to reversing recent overcompliance… Continue reading OPEC Compromise: Can Kicking Buys Time for Sanctions Rollout and Demand